Westfield Bankruptcy Exemptions Attorney

Bankruptcy may require you to say goodbye to your belongings. However, the law won’t let you be left with absolutely anything. Bankruptcy exemptions are those assets that bankruptcy cannot touch, meaning you can keep them despite filing for bankruptcy. With help from our Westfield bankruptcy exemptions attorney, you can rest assured that you will not lose everything you own.

If you’re ready to say goodbye to your debts, you can schedule a conversation at your Massachusetts bankruptcy law firm to discuss your bankruptcy filing!

Why do I need a Bankruptcy Exemptions Attorney in Massachusetts?

We know that those struggling financially might not want to engage a lawyer. After all, it’s another expense to juggle along with everything else. However, you can lose more if you opt not to hire an attorney. If you make even one error, you risk having your bankruptcy case dismissed by the bankruptcy court. Even worse, they can think you’re trying to commit fraud.

Eric Kornblum, a local bankruptcy lawyer, is here to help you eliminate your debt. Here’s what our Worchester bankruptcy attorney can offer:

- Experience in the practice area: Eric has spent more than two decades helping Massachusetts residents eliminate their financial worries. If you want an efficient and cost-effective bankruptcy procedure, you need someone who knows the ins and outs of the process and the United States bankruptcy code.

- Aggressive, diligent, and compassionate representation: You need tenacious legal representation to stand up for your cause if you are up against powerful corporations and greedy creditors. Eric offers that to anybody who comes to him for assistance.

- Dedication to ending your debt stress: Eric has devoted himself to assisting his clients in finding financial solutions and getting debt collectors to back off, both in and out of court, since he started his practice. He has also written books to help people find debt relief.

Eric offers great legal advice to customers from bankruptcy petition all the way to discharge. Schedule a conversation with us right now to discuss your debt relief options!

Start Living Worry-Free Today!

Eric has been helping clients discharge their debts for over 20 years. If you need help with filing bankruptcy, negotiating debts, avoiding foreclosure, and keeping your properties, you’ve come to the right place. Talk to us. We’re ready to listen!

What Are Bankruptcy Exemptions?

Exemptions protect certain types of property from bankruptcy proceedings. If you file for Chapter 7 bankruptcy, most of your property will be sold (and the proceeds are subsequently used to pay your debts). However, certain property types are exempt from Chapter 7 bankruptcy proceedings – allowing you to keep these assets. In a Chapter 13 bankruptcy, the value of the exempt property is not included when calculating your payment plan.

Contact a Westfield bankruptcy lawyer if you have questions about these different forms of bankruptcy.

While most states require you to use state-specific exemptions, Massachusetts allows you to choose between either state or federal exemptions. Depending on your situation, one set of exemptions may be more advantageous than the other.

What Are the Differences Between Federal and Massachusetts Bankruptcy Exemptions?

Unlike many states, Massachusetts residents filing for bankruptcy can choose between either the federal or Massachusetts bankruptcy exemptions. Before you file for bankruptcy, it’s important that you understand how each set of exemptions will impact your claim.

Federal bankruptcy exemptions include:

- Homestead (including your house, mobile home, co-op, or burial plots),

- Motor vehicle,

- Personal property (such as clothing, appliances, furniture, and books),

- Jewelry,

- Tools of your trade,

- Pensions,

- Public benefits (such as Social Security, Veterans’ benefits, and unemployment benefits),

- Alimony and child support, and

- Wildcard exemptions.

If you are married and filing a joint bankruptcy, you can double all of these exemptions.

Massachusetts bankruptcy exemptions include:

- Home or principal residence: the exemption value depends on whether you filed a Declaration of Homestead

- Are elderly or disabled,

- Rent your principal residence,

- Cemetery and burial plots,

- Motor vehicle,

- All necessary clothing and beds for the family,

- Necessary household furniture,

- One heating unit,

- Books,

- Jewelry,

- Tools of your trade,

- Pensions,

- Public benefits (such as Social Security, Veterans’ benefits, and unemployment benefits),

- Wages,

- Wildcard exemptions.

If you are married and filing for joint bankruptcy, all of these exemptions (except your principal residence exemption) are doubled.

How to Choose Between Federal and State Exemptions

Before you select the federal or Massachusetts exemptions, you should consider how they would impact your assets. Importantly, you cannot pick and choose between the various state and federal exemptions – instead, you must choose one system or the other.

Your decision will typically hinge on what property you want to retain after bankruptcy. For example, the Massachusetts bankruptcy exemptions are much more generous to homeowners than the federal exemptions. Moreover, the state exemptions allow you to retain a more valuable motor vehicle and more clothing, appliances, trade tools, and furniture.

However, federal bankruptcy exemptions allow you to keep more jewelry and offer a higher wildcard exemption. It can be difficult to understand your options without legal assistance fully. A Westfield bankruptcy lawyer can help you evaluate your debts and assets and formulate a comprehensive bankruptcy strategy.

Speak With a Westfield Bankruptcy Exemptions Lawyer today!

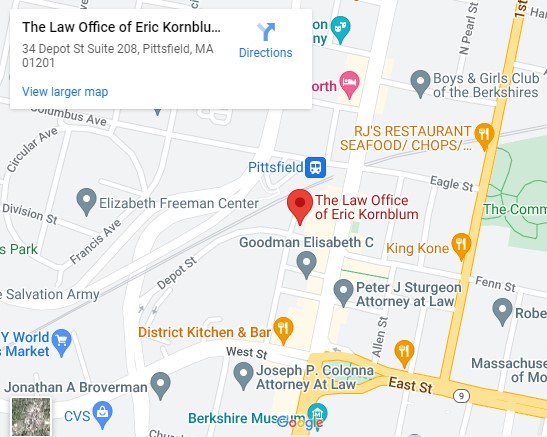

If you need help assessing how Massachusetts bankruptcy exemptions impact your claim, contact the Law Office of Eric Kornblum for a consultation as soon as possible. Our firm has been helping Massachusetts residents obtain financial freedom for over 20 years. Whether it’s a Chapter 7 liquidation or Chapter 13 case, we can help you find your way to a secured financial future. We look forward to speaking with you.

MA bankruptcy lawyer Eric Kornblum graduated from State University of New York, Binghamton in 1989 and received his law degree in 1992 at Western New England College, School of Law. Since opening his own practice, Eric has been dedicated to helping his clients resolve their financial problems both in and out of court.

MA bankruptcy lawyer Eric Kornblum graduated from State University of New York, Binghamton in 1989 and received his law degree in 1992 at Western New England College, School of Law. Since opening his own practice, Eric has been dedicated to helping his clients resolve their financial problems both in and out of court.